Welcome to the latest Quarterly Insight prepared by the FAS Investment Committee, designed to update you on their ongoing work and achievements, investment decisions reached this quarter and the actions taken to reposition the CDI portfolios in light of expected market conditions.

New year, similar outlook?

Global markets ended 2025 in good spirits, with many global equity indices standing close to all-time highs. Other assets, such as fixed income, also enjoyed a good year, leading to a positive overall performance for blended portfolios. The first month of 2026 has seen significant geopolitical news flow which has yet to dent market sentiment. The US earnings season has, by and large, seen the world’s largest quoted companies meet or exceed market expectations, and the nomination of Kevin Warsh as Federal Reserve chairman elect has not dampened the prospects of further monetary easing.

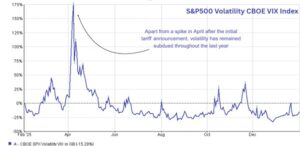

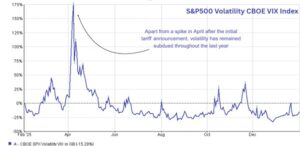

Despite the positive start, we expect to see greater volatility resurface as we progress through the year. Markets have shown little in the way of volatility over the last year, apart from the sharp increase immediately after the Liberation Day announcements in April 2025.

Economic growth is likely to slow later this year, and tariffs remain a threat to economic prosperity and have the potential to stoke inflationary pressure. Valuations within the tech sector remain challenging, and we feel a sense of unease about the increased debt burden that has fuelled capital expenditure to support investments into Artificial Intelligence. Increased volatility in precious metal markets over recent trading sessions serves as a timely reminder that sentiment can shift rapidly.

Opportunities present themselves in all market conditions, and we expect to see market attention turn to quality large cap stocks, with strong earnings, positive cashflow and attractive dividend yields over coming months. Away from equities, fixed interest securities are set to enjoy another positive year due to continued monetary easing in the US and UK.

CDI Quarterly Rebalance

Given the strong performance from the CDI portfolio suite during 2025, it is perhaps not surprising that the FAS Investment Committee have made limited changes to the CDI portfolios at the latest review.

The Committee have decided to keep the asset allocation broadly unchanged at this review, with the portfolio changes being largely fund specific. Portfolio turnover was modest during the latest rebalance, with two portfolios seeing no changes at this review point (CDI Adventurous and CDI High Income) and the other portfolio mandates (apart from the Future portfolios) seeing turnover of 8.5% or less. The Committee agreed to keep fixed income exposure at the short end of duration and remain content with allocations to Asia Pacific and European equities.

The lack of allocation to sectors such as minerals and defence have caused investment strategies which adopt a socially responsible approach to underperform over the last year. Whilst performance of our two socially responsible portfolios, Future Balanced and Future Progressive, remain strong compared to peers, they have not been immune to the general weakness amongst ethical strategies. As a result, the Committee have made more extensive changes to each of the Future portfolios with the aim of increasing performance without impacting the portfolio objective and allocation to socially responsible investments.

During the final months of last year, the Committee moved to reduce exposure to US equities, given concerns over the perceived complacency around tech valuations and debt levels, weak consumer confidence and geopolitical events. The Committee decided to place the proceeds from the reduction in US equity exposure in a short-term Money Market fund, which holds rolling deposits with major banking institutions, and keeps funds held as cash productive. Following the Committee’s assessment of current and expected conditions, it was agreed to retain the elevated cash positions at this review; however, the Committee will actively consider this position on an ongoing basis with a view to redeploying funds at an appropriate juncture.

The next scheduled portfolio rebalance will be in May 2026, although the Investment Committee will continue to monitor portfolio performance and consider economic and geopolitical factors on an ongoing basis. Should the Committee feel an interim rebalance is needed – as was the case in October last year – an ad hoc portfolio adjustment can be placed at short notice.

More than just performance

As one would expect, the pursuit of strong performance over the longer term drives the decisions taken by the FAS Investment Committee. The consistent outperformance delivered by the CDI portfolio range compared to recognised benchmarks and industry peers since inception, stands as testament to the FAS investment process and decisions taken.

Performance is, however, only one metric by which the portfolio returns should be measured; the level of risk taken to achieve those returns also needs to be considered. If portfolio outperformance comes at the expense of significant levels of additional risk, then this paints a different picture of the risk adjusted returns achieved. This is why our portfolio construction takes careful consideration of the level of portfolio risk – measured by volatility, maximum drawdown and Value at Risk – at each quarterly review. Using a range of analysis tools, the Committee can see the likely impact of decisions taken on portfolio volatility, and track whether the risk profile of an investment fund alters from review to review.

Summary

We hope you have found our latest Quarterly Insight of interest. We always welcome feedback, so please do let us know if you have any comments. Likewise, please contact us to discuss any aspect of the work of the FAS Investment Committee or would like more information on the performance or features of the CDI discretionary managed portfolio range.

Source: FE Analytics February 2026